Auto insurance laws and minimum requirements in the Badger State

Don’t drive a car unless you have insurance. It’s never worth the risk.

Yes, auto insurance can be expensive and you might feel like you don’t get a “benefit” from having it — until you do. Because that’s what insurance is... it hangs in the background of our lives, only relevant when we need to pay the premium. But then if you’re in a car accident, it suddenly becomes very, very important.

And most folks will be in a car accident eventually.

It’s not a lot, and most accidents don’t result in severe injuries.

However, even a “minor” accident with minimal personal injuries and damage to vehicles can cost a lot of money for medical treatment, vehicle repairs, and related expenses.

Importantly, though, even if you’re not concerned about the possibility of paying out of pocket for those costs, there are penalties for not having the required amount of insurance.

Let’s take a look at everything you need to know about Wisconsin car insurance laws and requirements.

Wisconsin car insurance requirements

These are the minimums for car insurance in Wisconsin:

| Type of coverage | Minimum amount | What it covers |

|---|---|---|

| Liability coverage for 1 person | $25,000 | Bodily injury or death of 1 person in an accident caused by the owner of the insured vehicle. This includes medical expenses, property damage, and other costs up to the limit of your coverage. |

| Liability coverage for more than 1 person | $50,000 | Total bodily injury or death for an accident caused by the owner of the insured vehicle |

| Liability coverage for property damage | $10,000 | Property damage per accident caused by the owner of the insured vehicle |

| Uninsured motorist | $25,000/person, $50,000/accident |

Bodily injury of a driver or their passengers if injured in an accident with an uninsured driver or in a hit-and-run. |

Types of auto insurance

Certain auto insurance is required by law, but you usually have the option to add components to your policy or be insured for a higher amount than the minimum.

Liability insurance and uninsured motorist insurance are required by law at certain minimum amounts. You can choose to purchase higher policy amounts if you wish.

Liability insurance (REQUIRED)

Bodily injury liability insurance covers claims for medical expenses, lost wages, pain and suffering, and other costs related to the accident. The insurance company will pay this coverage for an accident involving the insured vehicle that is caused by you, a member of your family who lives with you, or for a person who drove your car with your permission.

Property damage liability insurance covers property damage like a broken fence, mailbox, wall, etc. It does not cover damage to your own vehicle.

Uninsured motorist insurance (REQUIRED)

Uninsured motorist coverage covers you if you are injured by the fault of another person who does not have sufficient insurance for your damages. It would also apply if you’re the victim of a hit-and-run accident (or any accident where the at-fault individual does not provide accurate information to cover the costs of your injuries).

You’re required to have $25,000 per person/$50,000 per accident in uninsured motorist insurance, but you can elect to have more if you would prefer greater protection. Uninsured motorist insurance does not cover your property damage, only your bodily injuries.

Medical payments, or MedPay, insurance (OPTIONAL)

Medical or funeral expenses for yourself or others can be covered by medical payments insurance. This can include medical costs for treatments like hospital stays, surgery, x-rays and diagnostics, prosthetics, rehabilitation, ongoing therapies, prescription medication, and other items.

Usually, this covers expenses that are not covered by your regular health insurance plan. It could cover copays or deductibles, but often coverage only lasts for 1 year after the accident. This is not required, but must be offered to you when you purchase car insurance.

Property and physical damage insurance (OPTIONAL)

If your car was purchased with a loan, the lender likely requires you to purchase damage coverage for the car. Even if you own the car flat-out, damage coverage is a good idea. It would mean that if you’re in an accident, any damage to your car would need to be paid out-of-pocket.

If your car becomes a total loss, you’d have to pay down the remainder of what you owe to the lender, plus purchase or lease a new car (if you need one).

Collision and comprehensive insurance coverages would pay for the actual cash value of your car regardless of who is at fault.

- Collision insurance is used if your car has a collision with another car or stationary object.

- Comprehensive insurance would pay for damage to your car by any other cause. This could include fire, vandalism, flooding, hail, broken glass, falling objects, animals, theft, or other reasons. In other words, almost anything that isn’t a collision.

Alternative proof of financial responsibility

In rare situations, a driver could request to prove they have financial means to cover liability without insurance.

You can avoid purchasing auto insurance if you can show that you have:

- Surety bonds good for at least $60,000 in payments (equal to the minimum amount of bodily injury liability insurance);

- Real estate bonds listed in lien of at least $60,000 in payments and a combined $120,000 in stocks owned by 2 other individuals; or

- Cash deposit of $60,000 made to the Wisconsin Department of Transportation. The state could use the money to satisfy a court judgment against you if you’re at fault for a car accident.

How Wisconsin insurance payouts work after an accident

If you’re in an accident, the first question is going to be who was at fault.

Wisconsin is an at-fault state, which means the person who caused the accident is legally responsible for all parties’ costs related to the accident.

If you’re NOT at fault, these are your options for recovering damages (costs) for a Wisconsin accident:

- File a claim with your own insurance company. If the other driver is at fault, your insurance will likely pursue a subrogation claim against the at-fault driver’s policy.

- File a third-party claim directly with the at-fault driver’s insurance carrier.

- Settle privately with the other driver (i.e. “out of pocket”, instead of using insurance).

- File a personal injury lawsuit.

What does insurance cover after an accident?

Insurance is your first approach to receiving compensation for your losses. A plaintiff files a lawsuit if the insurance companies can’t settle on an agreeable amount or if the amount of your financial losses is greater than the amount of the relevant insurance policies.

The purpose of personal injury law is to make a plaintiff financially whole.

In other words, if you were injured because of someone else’s fault, you are entitled to be restored to the financial condition you would be in if the accident hadn’t happened.

Insurance (or a lawsuit) may be for an amount that would cover costs related to:

- Medical treatment, including doctor or hospital visits, emergency services and/or ambulance transport, prescription medications, diagnostic testing, surgery, etc.

- Assistive devices, prosthetics, or ongoing therapies

- Lost wages, including future lost earning capacity

- Household functions (cleaning, cooking, childcare, etc.)

- Wrongful death, if you lost a family member in an automobile accident

Wisconsin modified comparative fault rule (also known as the 51% Rule)

The state of Wisconsin follows the 51% Rule, which means a plaintiff must be less than 51% liable for the injury in order to recover damages.

Even if you didn’t cause an accident, the court (or insurance company) will try to determine if your actions contributed to it in some way.

For instance, if Driver A caused the accident by failing to stop at a red light, and Driver B had the right-of-way BUT was texting at the time of the crash, Driver B will be held partially responsible. The theory is that if Driver B had been driving carefully and not distracted by their phone, they would have been able to react quickly enough to avoid the accident.

The court or insurance company would then determine the percentage of Driver B’s liability. If Driver B is found to be more than 50% liable, they cannot recover any damages. If they are 50% or less liable, they can recover damages that are reduced by the percentage of their liability. If they were awarded $100,000 in damages but were 20% liable, the award would be reduced to $80,000.

4 tips for maximizing your insurance payout after a car accident

- Get immediate medical treatment. Even if you don’t think you’re injured, it’s worthwhile to be evaluated right away by a doctor, urgent care, or at a hospital. Some car accident injuries appear days or weeks after an accident. If you didn’t get immediate medical treatment, it can be difficult to prove that the injury was related to the accident.

- Obtain a police report at the scene. A police report is an important piece of evidence, and it also should include the contact information of all involved parties and witnesses. The insurance companies will rely heavily on this document when determining liability.

- Keep detailed records of all of your expenses. Record each time you visit a doctor, take time off from work, pay for a medication or service, and anything else related to the accident. Maintain a list that includes dates, providers’ names, what service was provided, and the cost. This way you’ll have an easily accessible, accurate record of what you’re owed. Also, keep any receipts that show the amounts paid or bills for amounts owed.

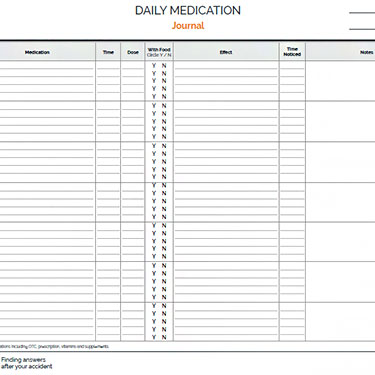

Medication Log Sheet

Medication Log Sheet

Printable daily medication log template helps you track your medicines and side effects

Download in PDF format![]()

- Know what to say, when, and to whom. You are the customer of your insurance company. But that doesn’t mean it will treat you as if “the customer is always right.” Rather, the way an insurance company makes a profit (because it IS a profit-based business) is by paying out the least amount of money possible to settle a claim. The insurance company’s objective is to settle a claim for as little as possible to satisfy you and then move on. It doesn’t have your best interests in mind... it wants to close the claim without spending too much time or money.How you speak to the insurance company, how you describe your role in the accident, and your negotiations on what you believe you’re owed, will be important for what you’re offered as a settlement — and that’s with your own insurance company. It can be even trickier when it’s the other driver’s insurance company.

You never want to admit fault. Don’t lie, but don’t set yourself up for failure, either. If you believe that you bear some liability for an accident, you can first consult a lawyer and have your lawyer negotiate with the insurance company.

You must report the accident to the insurance company as soon as possible after it happens. Many insurance companies won’t cover an accident if the insured has waited too long to report it. But a report is not the same as a claim. Even if you haven’t yet decided how you want to proceed, if the other driver says they want to pay out of pocket, or for any other reason you’re not ready to file a claim, that’s okay. Report the accident so you don’t lose your ability to make a claim.

Reporting the accident provides the insurance company with basic facts, like who was involved, the location of the accident, and other specifics. You don’t have to make a statement of fault. You can contact an attorney who will work with you to evaluate how the accident happened, who is at fault, and how to minimize your liability in order to maximize your insurance payout.

You can ask your lawyer to be the point of contact for the insurance company so you don’t make mistakes, and so that the claim is handled properly.

If you need a Wisconsin car accident lawyer, you can use the Enjuris law firm directory to find a lawyer near you who can help you get the most from your insurance settlement after a crash.

See our guide Choosing a personal injury attorney.